How to Upload Customer Tax Information's in Oracle Cloud: Customer Tax Registrations Interface in Oracle Cloud

In Oracle Cloud we can store Customer tax information's in the Customer Master. Cloud gives us the flexibility to store Customer Tax related information's in the Customer master. Then we can refer this Customer tax information's to default in the other cloud AR Transactions and in other Cloud reports too. Entering Customer tax information's manually in the Customer master is quite time consuming and not possible for mass customers but in Oracle cloud application , we have the flexibility to mass upload the customer Tax Information's in Oracle Cloud. In Oracle Cloud we have the customer Tax Registration Interface in Oracle Cloud to upload customer ax related information's.

Step by Step to Upload Customer Tax Information's in Oracle Cloud through Interface

Step1:- Go to Customer Master , Here below under Transaction Tax tab , go to Tax Registrations Tab to enter and maintain the customer Tax information's in Oracle Cloud.

Step2: - Now to Mass upload Customer Tax Information's in Oracle Cloud need to follow the below steps.

Go to Setup and Maintenance

Find the Manage Tax Regimes task as below

Go to Setup and Maintenance

Find the Manage Tax Regimes task as below

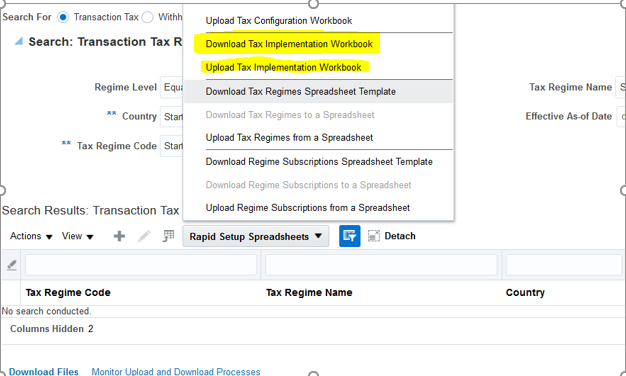

Step3:- Now we need to Click on the 'Rapid Setup Spreadsheets' Drop Down List to download the Tax Registrations excel sheet for upload supplier tax registrations information.

Step4:- Select the 'Download Tax Implementation Workbook' to download the Supplier Tax registration in your desktop.

Step5:- This is the 'TaxImplWorkbookTemplate.xlsm' template where we need to put the Customer Tax information's to upload in the Cloud Application

To enter the Tax Registrations in Customer Site level , We need to Select the Party Type 'Customer Site' and enter the Customer Site Number in the Party Number Column Field.

Enter the Customer Name in the Party Name column Field

Check the Tax Regime Code created in your Instance and copy the name of the Tax Regime Code in the Tax Regime code Field.

Enter the Tax Registration number in the Registration Number Field.

Once the Sheet is Ready now prepare the Zip file from that sheet to Click on the First Sheet of the ''TaxImplWorkbookTemplate.xlsm'' and Click the Generate csv File.

Step7:-Step7:- Once the Zip File is Ready , now Click on the Upload Tax Implementation workbook to upload the Zip File.

Step8:- Now Click on the Monitor Upload and Download Processes tab to see the status of the Upload Tax Implementation Workbook.

0 comments:

Post a Comment