TOP

20 general ledger interview questions in oracle apps r12

Here in this Post, I am sharing the Top 20 general ledger

interview questions, which is most frequently asked by the Interviewer. I have

shared the Detail Answers with Working example for these Interview questions for

more understanding.

TOP 20 General ledger interview questions List

What

is Recurring Journals?

Answers: Recurring journals uses for that entries which we

entered or reported every month. With the Help of Recurring Journals, we don’t

need to enter these manually every month but instead off system will do this

automatically.

Three

Recurring Journals

Skeleton

Journal Entries: Skeleton entries affect the same accounts each period, but have

different posting amounts.

Standard

Recurring Journal Entries:

Standard recurring journal entries use the same accounts and amounts each

period.

Recurring

Journal Formula Entries: Formula

entries use formulas to calculate journal amounts that vary from period to

period.

What is Encumbrance Accounting in Oracle ?

Answers :

Encumbrance

Accounting is uses in the general Ledger to put the Budgetary control in

System. This helps to implement the Budget in the System and to stop the system

to cross the budget Limits. Encumbrance Accounting checks for the Fund to be

available in the Budget for the given GL account combination. We can record the

pre-expenditures using this feature in oracle.

What is Revaluation in General

Ledger ?

Answers :

We

use Revaluation for the Foreign currency amounts. This helps to evaluate the exact amount of

Liability and revenue for the period During Month End or unrealized gain/loss

amount which occurred due to foreign exchange rate fluctuations. Revaluation

happens on the account level. We can choose for which account we need to run

the Revaluation. For Example, My Total Liability as per my GL account is 2 Lakh

in which many of the invoices are foreign currency. So system has fetch the

exchange rate as per the Invoice Date and calculate the Liability but in actual

this Liability is Wrong because if now I have to pay this Invoice I have to pay

with the Current Exchange rate so that is the same thing Revaluation process

does in the General Leger In which It create the Revaluation Journal based on

the Current Exchange rate for the difference of the exchange rate price and

evaluate the final Profit and Loss so by this way , we do have right figures in

the hand about liability and the revenue . Revaluation only do for GL

accounts. Revaluation process runs

during the period end. This process creates the Journal Entry that either

Increase or decrease the functional currency amount for that GL account. In the

Revolution Process also, this unrealized gain/loss Journal will be auto revered

during the beginning of the next period. So, this makes the revaluation process

completes.

What is Translation in general

Ledger ?

Answers :

If

you have an Requirment to prepares the Financial ratings in other currency from

your functional Leger currency then translation is the best option for this.

This helps to convert your GL balances from your Functional Currency to any

other currency. The Good part of the Translation is this, you can do the

translation for your Actual and Budgeted GL Balances.

Oracle has given the Translation

Program to convert the Balances to create financial reporting’s. You need to

run this Program once your GL Period has been end.

Difference

between Translation and Revaluation in General Ledger?

Answers :

Revaluation

is used to find the unrealized gain/loss amount which occurred due to foreign

exchange rate fluctuations. This only happens for the Foreign Currency

transactions but on the Other Hand Translation is totally different, this is

used to convert the Prepared the GL balances in to Other Currency. The helps to

prepare the Financials GL reporting’s in other currency from your functional

Leger currency. Revaluation happen during the month end but translation happed

after Period end activities. Both Revaluation and Translation happens for GL

accounts.

What are the Types of Journal

Entries in GL?

Manual Journal Entry: - Most Common

Journal entry to create the Basic GL journal Accounting Transactions.

Reverse Journal Entry: - This

Journal entry related to the reversal of the Original Manual Journal

entry. We can Post, the Reverse Journal

in the Current Open Month or in the Future Opening Periods too.

Recurring Journal entries: - This

type of Journal Entries crested only once but it automatically repeats for each

Accounting Period or Month as per the rules.

Mass allocation: -

Mass Allocations are journal

entries that utilize a single journal entry formula to allocate balances across

a group of cost centers, departments, divisions or other segments;

What is Balancing segment in the

Chart of accounts?

Answers :

Balancing Segment is one of the

Import part of the chart of Accounts or Accounting Flexfield. In Oracle

Accounting Flexfield is the combination of Multiple segments values. Each

Segment values represent the one of the characteristics of the Chart of Account

like (Company, Location, Cost Center, Department, Sub Account, Project like

many). But in these GL segments combination we should have one Segment which

could be act like Balancing Segments.

Balancing Segments helps to ensure

that all journal entries balance for each value of the balancing segment and to

ensure that entries that impact more than one balancing segment use the

appropriate intercompany Account. Balancing Segments helps to make balancing the

GL journals. We can define only one balancing segment for a one chart of

account. It is best practice for the balancing segment to equate to company so

that the debits and credits in the General Ledger balance by company.

What is Natural Account in Chart of

account and What Is the Purpose of this ?

Answers :

Natural

Account is one of the Important segment of the accounting Flexfield. No char of

Account or Accounting KFF can design without using the Natural Account Type. We

have to enable one of the Chart of accounts(KFF) segments to Natural Account”.

Natural Account Segment Type

represent the Type of accounts Values in the Natural Account Segments (Like

Asset, Expense, Liability, Revenue, Ownership). Only one natural account

segment can be defined in a chart of accounts.

What are the Ledger Components in GL?

Answers :

Ledger consists of 4C’s. 4 C’s are.

1.Chart of Accounts: Chart of

Account is the Accounting Flex Field attached to this ledger.

2.Calendar: - Ledger Financial Year

will be based on this Calendar.

3.Currency: - Ledger Functional

currency. GL reporting will be based on this Currency. Based on this System

Determines the foreign Currency in the Leger.

4.Accounting Method: - This

determine the Costing method of this Ledger more about Inventory. Two Costing

Methods (Standard Cost and Average cost).

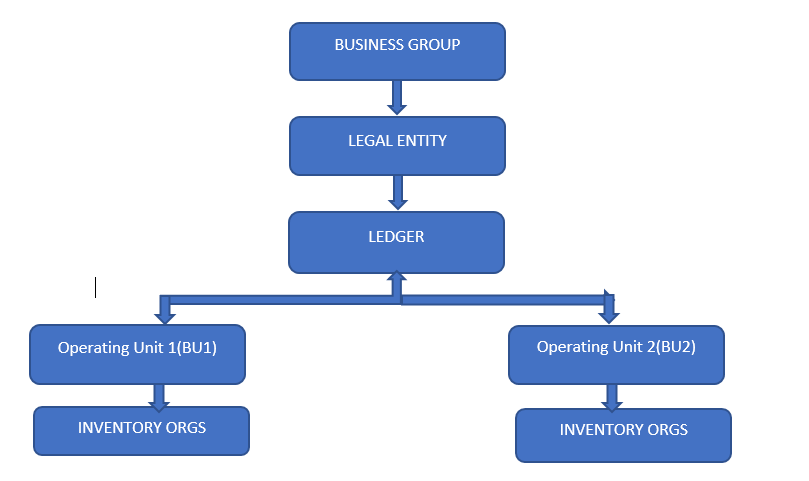

How many Business Units we can

create under one Ledger?

Answers :

We can create any number of BU’s

under one Ledger. The Count is not restricted. Each Business Unit under single

Ledger will share the share Same Chart of Accounts, currency and the Calendar

but If your Business unit have different financial Period or Base Currency then

you must create the New Ledger for this BU.

Can We close the Accounting

Period’s for the Different Business Units under single Ledger separately?

Answers :

No, we cannot close the Accounting

Period for Different Business units for the same ledger separately. The Reason

is We are sharing the Same Ledger so in the Ledger there will be only one

Calendar which is shared to both Business Units. So, it means if one Business

unit will close the Accounting Period then the period will be close to both

Business unit for this Ledger.

Where is the Place of an Legal

Entity in an Organization structure in Oracle General Ledger?

Answers :

A

legally recognized entity can own and trade assets and employ people; while an

entity without legal recognition cannot.

What is a funding budget?

Answers:

A budget against which accounting

transactions are checked for available funds when budgetary control is enable

for your set of books.

Journal Import in General Ledger?

Answers :

Journal Import is uses to Import

the GL journals from Oracle application Modules and from External Sources. When

we create the Accounting in Oracle Sub Modules like Payables receivable with

Transfer to GL yes but Post to GL “No” then Create accounting do the accounting

of All the transactions and create the Journal entries and transfer these GL

entries to the General Ledger because you have run the Accounting with Post to

GL “No” then these Journals stop in this Journal Import form. Then we select

the Sources manually to import or Post these Journal in the General Ledger. The

same thing work for External Source Journals.

What are the GL Tables in Oracle apps?

Answers:

Gl_JE_BATCHES

GL_JE_HEADERS

GL_JE_LINES

GL_PERIODS

GL_BALANCES

GL_IMPORT_REFRENCES

TOP 20 general ledger interview questions in oracle apps r12

8 comments:

Oracle Fusion HCM Online Training

Oracle Fusion SCM Online Training

Oracle Fusion Financials Online Training

oracle fusion financials classroom training

Oracle Fusion HCM Training in Hyderabad

Nice blog

Oracle Fusion HCM Training

Good Blog, well descrided, Thanks for sharing this information

Oracle Fusion HCM online Training

Good Blog, well descrided, Thanks for sharing this information

Oracle Fusion SCM Training

Very helpful

thanks for your comments !!

Those guidelines additionally worked to become a good way to recognize that other people online have the identical fervor like mine to grasp a great deal more around this condition. and I could assume you are an expert on this subject. Same as your blog i found another one smconsultant.com

Post a Comment