Auto Accounting Rule Setup in Oracle Fusion

In Oracle Receivable Auto Accounting Rule helps you to

determine the General Ledger accounts for AR transactions that you enters manually

or importing through Auto Invoice Import. System drives the GL account from

these Auto Accounting Rules for AR transactions. With the help of Auto

Accounting Rule, All the GL segments automatically derived in Oracle

receivables transactions.

Receivables

creates default accounts for revenue, receivable, freight, tax, unearned

revenue, unbilled receivable, finance charges, and AutoInvoice clearing

(suspense) accounts using this information.

When you enter

transactions in Receivables, you can override the default general ledger

accounts that Auto Accounting creates.

You can control the

value that Auto Accounting assigns to each segment of your Accounting Flex

field, such as Company, Division, or Account.

We can define Auto

Accounting rules for these below types.

- Freight:

The freight account for your transaction.

- Receivable:

The receivable account for your transaction.

- Revenue: The

revenue and finance charges account for your transaction.

- AutoInvoice Clearing: The clearing account for your imported transactions. Receivables

uses the clearing account to hold any difference between the specified

revenue amount and the selling price times the quantity for imported

invoice lines. Receivables only uses the clearing account if you have

enabled this feature for the invoice batch source of your imported

transactions.

- Tax:

The tax account for your transaction.

- Unbilled Receivable:

The unbilled receivable account for your transaction. Receivables uses

this account when you use the Bill In Arrears invoicing rule. If your accounting

rule recognizes revenue before your invoicing rule bills it, Receivables

uses this account.

- Unearned Revenue:

The unearned revenue account for your transaction. Receivables uses this

account when you use the Bill In Advance invoicing rule. If your

accounting rule recognizes revenue after your invoicing rule bills it,

Receivables uses this account.

For each segment, enter either the table name or

constant value that you want Receivables to use to get information. When you

enter an account Type, Receivables displays all of the segment names in your

Accounting Flexfield Structure. Segments include such information as Company,

Product, Account, and Sub-Account. Receivables lets you use different table

names for different accounts. Choose one of the following table names:

- Salesreps: Enter

this option to use salesperson when determining your revenue, freight,

receivable, AutoInvoice clearing, tax, unbilled receivable, and unearned

revenue accounts. If you choose this option for your AutoInvoice clearing,

tax, or unearned revenue accounts, Receivables uses the revenue account

associated with this salesperson. If you choose this option for your

unbilled receivable account, Receivables uses the receivable account

associated with this salesperson.

- Transaction Types:

Enter this option to use transaction types when determining your revenue,

freight, receivable, AutoInvoice clearing, tax, unbilled receivable, and

unearned revenue accounts.

- Standard Lines:

Enter this option to use the standard memo line item or inventory item

you selected when determining your revenue, AutoInvoice clearing,

freight, tax, unbilled receivable, and unearned revenue accounts. If you

choose this option for your AutoInvoice clearing, freight, tax, unbilled

receivable or unearned revenue accounts, Receivables uses the revenue

account associated to this standard memo line item or inventory item. If

the transaction has a line type of "LINE" with an inventory

item of freight ("FRT"), Auto Accounting uses the accounting

rules for the freight type account rather than the revenue type account.

- Taxes:

Enter this option to use tax codes when determining your tax account.

4. If you did not enter a Table Name, enter a

Constant value for this segment, or select one from the list of values.

Step1:-

Go to Navigator è Setup and Maintenance

Step2:-

Find the Manage Auto accounting rule from Search option ad below.

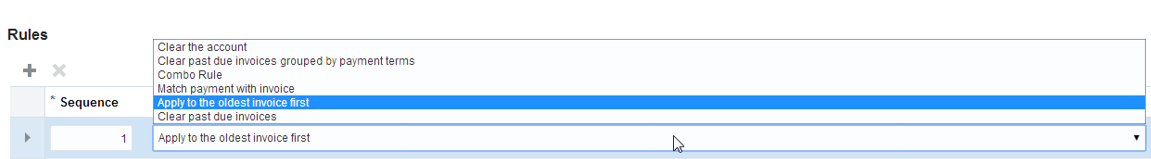

Step3:- As Below , Define the Auto Accounting rule for specific Account Type for Particular Business Unit.

Step4:- When you will create Auto Accounting rule for specific Account Type then as below automatically system will show you all the accounting KFF.

When you enter an account Type, Receivables displays all of the segment names in your Accounting Flex field Structure. Segments include such information as Company, Product, Account, and Sub-Account. Receivables lets you use different table names for different accounts. Choose one of the following table names: