skip to main |

skip to sidebar

AR to GL reconciliation in oracle apps r12

Set the override email address in Oracle Fusion

How to Create PO and Receiving Inquiry(View Only) Role in Oracle Fusion

How to create a new Oracle apps Data base source to Design the BIP reports

How to add hyperlink in the email body using Bursting in Oracle Cloud BIP reports

What is Rapid Implementation in Oracle Cloud : Rapid Implementation Data Upload Process in Oracle Fusion

Drill Down OTBI reports to Navigate Directly in to Oracle Cloud Payment Page

How to create vacation rules in Oracle cloud

TOP 30 Most Important OAF Interview Questions

The purpose of this blog , is to do Knowledge sharing with my Followers through my own Experiences. Contact us for Oracle Applications Job Support , Project Support and any other freelancing work.

Know More About Us

Oracle Fusion/EBS Interview's Question Answer Series

- Top 33 Oracle Fusion Order Management Interview Questions

- TOP 31 Oracle Fusion SCM Cloud Interview Questions

- TOP 21 Oracle Fusion HCM Interview Questions

- Complete Tax Setups in Oracle Fusion

- Top 50 oracle reports interview questions

- 33 Most Important Oracle Fusion fixed assets interview questions

- TOP 33 Most Important Oracle Apps Technical Interview Questions

- 25 Most Important Oracle receivable interview questions

- 21 Most Important Oracle r12 Payables Interview Questions

- TOP 20 general ledger interview questions in oracle apps r12

- TOP 23 Most Important Oracle Fusion Interview Questions

- TOP 23 Most Important oaf interview questions

Online Oracle Courses (Free of Cost)

- Complete Tax Setups in Oracle Fusion

- Learn Tax Implementation in Oracle Fusion

- Learn P2P Cycle in Oracle Fusion

- Learn Oracle Reports XML Tutorial

- Learn Oracle Fusion Custom Roles Tutorial

- Learn Oracle Fusion Technical Online

- Learn Oracle Fusion/cloud Financials Online

- Learn Oracle Cloud BPM Online

- Learn Complete OAF Step by Step Online

- Learn Oracle Workflow Builder Online

Online Fusion Application Composer/Customization Book

Contact Me

OracleApplicationsBlog@gmail.comMost Viewed Posts

Report Bursting in oracle fusionAR to GL reconciliation in oracle apps r12

Set the override email address in Oracle Fusion

How to Create PO and Receiving Inquiry(View Only) Role in Oracle Fusion

How to create a new Oracle apps Data base source to Design the BIP reports

How to add hyperlink in the email body using Bursting in Oracle Cloud BIP reports

What is Rapid Implementation in Oracle Cloud : Rapid Implementation Data Upload Process in Oracle Fusion

Drill Down OTBI reports to Navigate Directly in to Oracle Cloud Payment Page

How to create vacation rules in Oracle cloud

TOP 30 Most Important OAF Interview Questions

4 comments:

Such a nice blog, I really like what you write in this blog, I also have some relevant Information like this blog.

Oracle Fusion Financials Online Training

Good Blog,thanks for sharing this informative article.

Oracle Fusion SCM Online Training

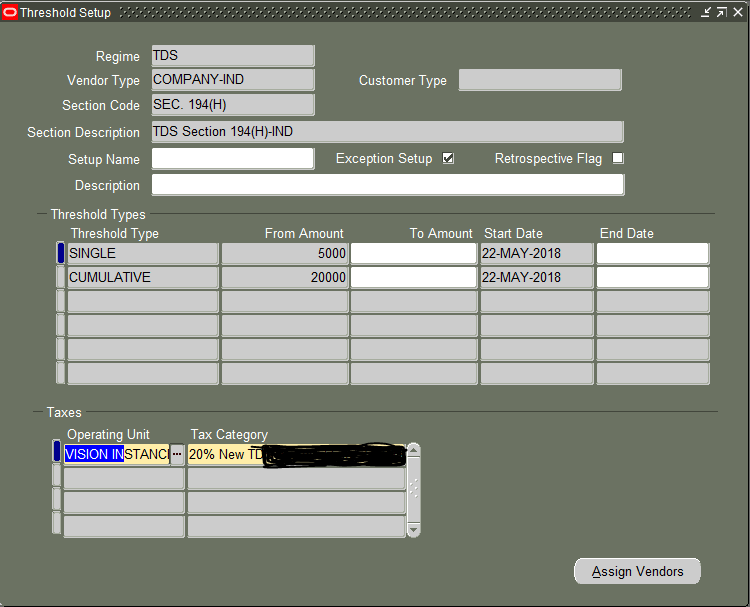

i want to setup cummulativae threshold but with condition that after crossing threshold limit the TDS should be calculated on excess amount only.

eg. if threshold limit is from 10,000 and my over all invoices amount for a party from all division is 13,000. then my tds will be deducted on only 3000.

10000 will be exempted.

Thanks for the Blog. Its such a good blog.

Post a Comment