GST implementation in oracle apps r12

In this post , we will discuss about GST implementation in oracle apps r12. We will show you all the steps in Oracle apps r12 , to do Setups/Implementation of GST in Oracle application. You will find all the GST Configurations details step by step in this post. You just need to make these setups in your application to start Implementing GST in Oracle apps r12.

Configurations for GST implementation in oracle apps r12

Step1:- First you need to apply the Patch in your application environment , to get all the GST Things created by the Oracle application for GST India.

Step2:- Once you have applied the Oracle Given GST patches then you need to do the setups as below.

First create a new supplier for GST setup in Oracle Application

Create New Supplier ‘GST Supplier’

Supplier Type should be ‘ India Tax Authority’

Create a New Site Also.

Setup è Calendar è Accounting è Period

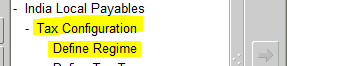

Go to India Local Payables è Define Regime

After creating supplier , we need to create First GST regime as below.

Here we will attach the GST supplier created Above and the GST calendar too.

Now we will define GST Tax Types (CGST, SGST, UGST)

|

| Add caption |

Here we are creating GST tax types(CGST,SGST,UGST) as below.

Select the regime ‘GST’

Tax Type ‘CGST’ . Check the Recoverable Tax check box.

Under accounting Tab , Select the Ledger and Operating Unit for which you want to configure the GST setup.

Enter the Interim Recovery & Recovery account.

Enter the Interim Liability & Liability account. There are required for the setup.

Create the Tax types same as above for SGST & UGST.

This topic is quite Large so i will post rest of the steps in the second post. We will create GST Tax Rates , GST Tax category and Party registrations part in the Second Post.

3 comments:

Nice document. Thank you.

Please Share the GST Settlement Process Document.

At present , we have not prepared the Settlement Process Document but we will try to share in future blogs :)

Post a Comment