Chapter 13: Oracle Fusion Tax Implementation

Hi friends, We are in the Oracle Fusion Tax Implementation series. This is the Lesson number 13 of this series. Lets start and learn how to Implement the Taxation in Oracle Fusion.

Creating Tax Status for all GST Taxes under Tax Regime

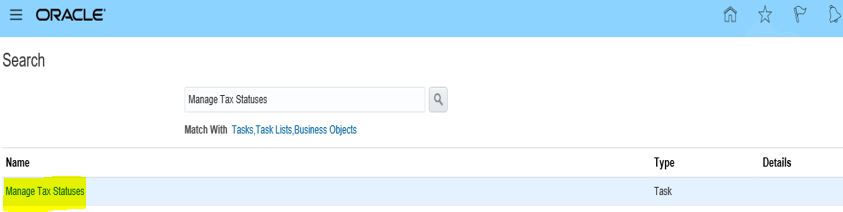

Go to ‘Manage Tax Statuses’ task to create the Tax statuses for GST Taxes.

|

| Creating Tax Status for all GST Taxes under Tax Regime |

Click on the ‘+’ icon to create the

|

| Creating Tax Status for all GST Taxes under Tax Regime |

Creating Tax Status for CGST Tax under GST Tax Regime

Tax Regime Code: INDIA GST1

Configuration Owner: ABC CORP

Tax: INDIA CGST

TAX STATUS CODE: STANDARD

TAX STATUS NAME: STANDARD

Start Date: Date should be same as Regime start Date.

Set as Default tax status: Yes

Default Start Date: Date should be same as Regime start Date.

Controls and Defaults:

Allow Tax Exceptions: Yes

Allow Tax Exemption: Yes

Allow tax rate override: Yes.

|

| Creating Tax Status for all GST Taxes under Tax Regime |

0 comments:

Post a Comment