Chapter 3: Oracle Fusion Tax Implementation

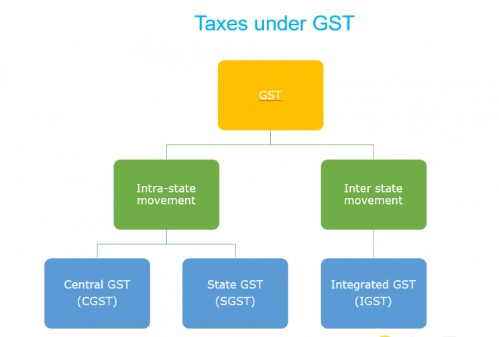

GST Transaction Tax Types: -

- Intra-State supply of goods or

services is

when the location of the supplier and the place of supply i.e., location

of the buyer are in the same state. In Intra-State transactions, a

seller has to collect both CGST and SGST from the buyer.

The CGST gets deposited with Central Government and SGST gets deposited

with State Government.

- Inter-State supply of goods or services is when the location of the supplier and the place of supply are in different states. Also, in cases of export or import of goods or services or when the supply of goods or services is made to or by a SEZ unit, the transaction is assumed to be Inter-State. In an Inter-State transaction, a seller must collect IGST from the buyer.

|

| Chapter 3: Oracle Fusion Tax Implementation |

Working Example for CGST and SGST:

· Let’s suppose Ravi is a dealer in Maharashtra who sold goods to Rakesh

in Maharashtra worth Rs. 10,000. The GST

rate is 18% comprising of CGST rate of 9% and SGST rate of

9%. In such case, the dealer collects Rs. 1800 of which Rs. 900 will go to

the Central Government and Rs. 900 will go to the Maharashtra Government.

Working Example for IGST:

Consider that a businessman Rajesh from Maharashtra had sold goods to Anand from Gujarat worth Rs. 1,00,000. The GST rate is 18% comprised of 18% IGST. In such case, the dealer has to charge Rs. 18,000 as IGST. This IGST will go to the Centre.

India GST Tax Hierarchy: -

|

| Chapter 3: Oracle Fusion Tax Implementation |

0 comments:

Post a Comment