Creating AP Invoice and Applying the Withholding Tax (TDS) for Testing

Here below, we have created the AP Invoice and we will apply the Withholding Tax (TDS).

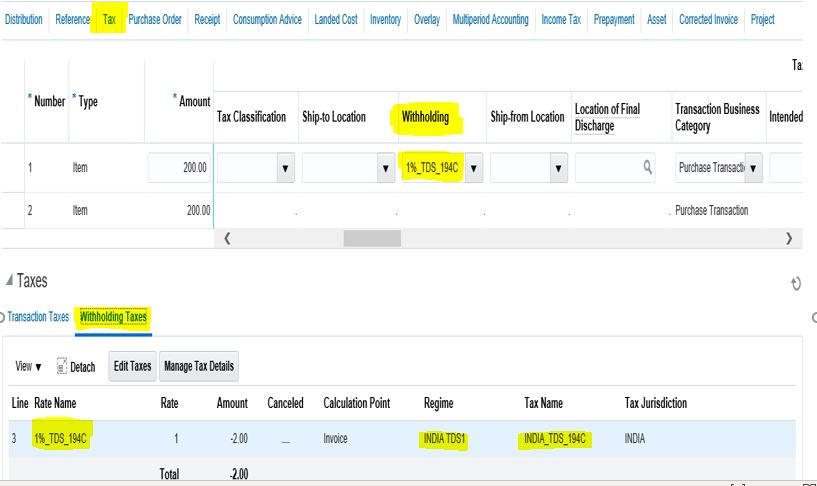

Go to AP Invoice Lines. Click on the ‘Tax’ Tab as highlighted below.

Under Withholding Classification Code Field, we need to select the Withholding Tax which we want to apply for this Invoice Line.

Note: If you are not able to see the Withholding Classification Code Field , then you need to go to View Option and then select the option to View all columns. By this way , we can able to see the Withholding Classification Code Field under Tax Tab.

Here in Withholding Classification Code Field, we can able to see all the Withholding Taxes. We need to select the Tax as per our Requirment.

|

| Creating AP Invoice and Applying the Withholding Tax (TDS) |

After Selecting the Tax, we need to go to the Invoice Header and select the Invoice Actions Option tab. Select the Calculate Tax Option as highlighted below.

Under Withholding Classification Code Field, we have selected the Withholding Tax ‘1%TDS_194C’ which we want to apply for this Invoice Line.

|

| Creating AP Invoice and Applying the Withholding Tax (TDS) |

After Calculate Tax, we can see below Lines, Tax is showing calculated for the AP Invoice under the Withholding Taxes Tab.

|

| Creating AP Invoice and Applying the Withholding Tax (TDS) |

|

| Creating AP Invoice and Applying the Withholding Tax (TDS) |

0 comments:

Post a Comment