Oracle Fusion Tax Configuration

2 types of Tax Configuration in Oracle Fusion

What is Transaction Tax ?

A tax, that you pay when you buy or sell something in any country that is called the Transaction Tax. As per the Country rule regulation, if we are doing some businesses in that country either doing some sell or purchase something, then we must pay some amount of tax to the country as per the transaction amount and that is called the transaction tax. The amount of Transaction tax on Bill Payments is usually a fixed percentage. Every country has setup their own rates for Transaction Tax. Transaction Tax may vary country to country. Even for Country, there are multiple Transaction tax rates/percentage as pee the Goods and service category.

What is WithHolding Tax ?

A withholding tax , is an income tax to be paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, withholding tax applies to employment income. Many jurisdictions also require withholding tax on the payments of Suppliers Invoice Bill’s. In most jurisdictions, there are additional withholding tax obligations if the recipient of the income is resident in a different jurisdiction, and in those circumstances withholding tax sometimes applies to royalties, rent or even the sale of real estate.

Typically, the withholding tax is treated as a payment on account of the recipient's final tax liability, when the withholding is made in advance. It may be refunded if it is determined, when a tax return is filed, that the recipient's tax liability to the government which received the withholding tax is less than the tax withheld, or additional tax may be due if it is determined that the recipient's tax liability is more than the withholding tax. In some cases, the withholding tax is treated as discharging the recipient's tax liability, and no tax return or additional tax is required. Such withholding is known as final withholding.

The amount of withholding tax on income payments other than employment income is usually a fixed percentage.

|

| Oracle Fusion Tax Configuration |

Complete Introduction of India GST Transaction Tax

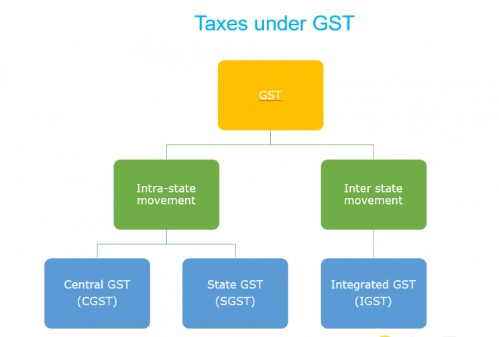

Unlike earlier when there were multiple taxes such as Central Excise, Service Tax and State VAT etc., under GST, there is just one tax. GST is categorized into CGST, SGST or IGST depending on whether the transaction is Intra-State or Inter-State.

To determine whether Central Goods & Services Tax (CGST), State Goods & Services Tax (SGST) or Integrated Goods & Services Tax (IGST) will be applicable in a taxable transaction, it is important to first know if the transaction is an Intra State or an Inter-State supply.

GST Transaction Tax Types: -

- Intra-State supply of goods or services is when the location of the supplier and the place of supply i.e., location of the buyer are in the same state. In Intra-State transactions, a seller has to collect both CGST and SGST from the buyer. The CGST gets deposited with Central Government and SGST gets deposited with State Government.

- Inter-State supply of goods or services is when the location of the supplier and the place of supply are in different states. Also, in cases of export or import of goods or services or when the supply of goods or services is made to or by a SEZ unit, the transaction is assumed to be Inter-State. In an Inter-State transaction, a seller must collect IGST from the buyer.

|

| Oracle Fusion Tax Configuration |

Working Example for CGST and SGST:

· Let’s suppose Ravi is a dealer in Maharashtra who sold goods to Rakesh in Maharashtra worth Rs. 10,000. The GST rate is 18% comprising of CGST rate of 9% and SGST rate of 9%. In such case, the dealer collects Rs. 1800 of which Rs. 900 will go to the Central Government and Rs. 900 will go to the Maharashtra Government.

Working Example for IGST:

Consider that a businessman Rajesh from Maharashtra had sold goods to Anand from Gujarat worth Rs. 1,00,000. The GST rate is 18% comprised of 18% IGST. In such case, the dealer has to charge Rs. 18,000 as IGST. This IGST will go to the Centre.

India GST Tax Hierarchy: -

|

| Oracle Fusion Tax Configuration |

Analyzing Your Tax Requirements

The following table represents key decisions that you must make when you analyze your tax requirements and use Oracle Fusion Tax and other Oracle Fusion applications to implement a solution

Question | Consideration | Impact to Tax Configuration |

Who am I? | You must first answer questions about yourself and your relationship to the legal and regulatory agencies that enable you to operate in one or more counties. | |

Where do I have operations and businesses? | Identify the countries in which you operate. You will need to identify the country where you are legally registered and the countries where you have subsidiary companies that are legally registered or have a legal presence. | Use Oracle Fusion Legal Entity Configurator to capture information about your legal entities and legal registration. |

What taxes am I subject to? | Analyze your tax environment for each of the countries in which you operate. | Set up your tax regimes, taxes, and tax jurisdictions according to the tax requirements for each country. |

What are the operations and businesses that I have? | Consider the types of operations and businesses in which you are engaged and the countries where you have legal entities or reporting units. The type of industries that you work under (for example, mining, telecommunications, and pharmaceuticals), the kind of operations in which you engage (for example, trading, manufacturing, and services), and the scale of your operations (for example, your turnover, company size, and growth) may all impact your taxability. | Use the classifications feature to categorize or classify your first parties under various classification schemes. In analyzing your operations, you can associate the three main classifications of a transaction to: What you do: Use transaction fiscal classifications. What products you buy or sell: Use product fiscal classifications. Who your customers and suppliers are: Use party fiscal classifications. |

What do I do? | Identify and classify the transactions that you enter into. For example, do you primarily sell physical goods? If you do, do you manufacture them, or do you buy and sell them without additional manufacturing? Do you sell these goods in another state or province? Do you export these goods? Do you provide or use services? | Use Oracle Fusion Tax to create fiscal classifications to classify and categorize your transactions in a common manner across your organization. Use these fiscal classifications in tax rules to obtain the appropriate tax result. |

What products do I buy or sell? | Determine the products that you buy and sell as they impact the taxes to which you are subject. For example, you must register for, and therefore collect and remit, service taxes only if you provide taxable services. If you manufacture goods for export, you may not be subject to taxes on the purchases that go into the manufacture of such goods. | Where Oracle Fusion Inventory is installed use the Inventory Catalog feature with Oracle Fusion Tax product fiscal classifications and intended use functionality to classify the taxable nature and intended use of the items. You can then define tax rules using these classifications to obtain the appropriate tax result. Define product category and noninventory-based intended use fiscal classifications to address classification needs for transactions that do not use inventory items. |

Who are my customers and suppliers? | Determine the types of customers and suppliers with whom you do business, as they can impact the taxes to which you are subject or the tax status or tax rate that applies. For example, let's say that you are a company in the UK that supplies physical goods to another country that is also a member of the European Union. The transaction rate for UK VAT is dependent on whether the customer is registered for VAT in the country to which the supply is made. | Use the party classifications feature to categorize or classify your customers and suppliers. You can use these classifications in your tax rules to derive the appropriate tax result. You create a party fiscal classification by assigning an Oracle Fusion Trading Community Model class category to a party fiscal classification type code that you define. The Trading Community Model class codes defined under the class category become fiscal classification codes belonging to the party fiscal classification type. You can create a hierarchy of party fiscal classification types to reflect the levels of codes and subcodes within the Trading Community Model classification. |

Implementation of Transaction Tax (GST) in Oracle Fusion

|

| Oracle Fusion Tax Configuration |

India GST Transaction Tax Rates

Role of Tax Classification codes in Oracle Fusion:

Defining Tax Classification codes for GST Transaction Tax in Oracle Fusion

Intra States Tax Classification codes

1. Local 5%

2. Local 12%

3. Local 18%

4. Local 28%

|

| Chapter 5: Oracle Fusion Tax Implementation |

Tax Classification Code ‘Local 5%’ Will Split internally in two Tax Rates.

1. 2.5% SGST

2. 2.5% CGST

Tax Classification Code ‘Local 12%’ Will Split internally in two Tax Rates

1. 6% SGST

2. 6% CGST

Tax Classification Code 18% Will Split internally in two Tax Rates.

1. 9% SGST

2. 9% CGST

Tax Classification Code ‘Local 28% ‘ tax Will Split internally in two Tax Rates.

1. 14% SGST

2. 14% CGST

Inter States Tax Classification Codes

For All Inter State/ Other States Purchases We are creating these below Tax Classification codes. We can give any name as per our business Requirment and for easy identification. These are tax classification codes will be show in the Transaction Tax Window for apply.

1. Other State Purchase 5%

2. Other State Purchase 12%

3. Other State Purchase 18%

4. Other State Purchase 28%

For Tax Classification code ‘Other State Purchase 5%’ Tax, we are creating only single tax rate as the complete tax will be go Center Government.

1. 5%IGST

For Tax Classification code ‘Other State Purchase 12%’ Tax, we are creating only single tax rate as the complete tax will be go Center Government.

1. 12%IGST

For Tax Classification code ‘Other State Purchase 18%’ Tax, we are creating only single tax rate as the complete tax will be go Center Government.

1. 18%IGST

For Tax Classification code ‘Other State Purchase 28%’ Tax, we are creating only single tax rate as the complete tax will be go Center Government.

1. 28%IGST

As a Summary, we will create these below Tax Classification code

1. Local 5%

2. Local 12%

3. Local 18%

4. Local 28%

5. Other State Purchase 5%

6. Other State Purchase 12%

7. Other State Purchase 18%

8. Other State Purchase 28%

0 comments:

Post a Comment