TDS Setup in Oracle Fusion

Hi friends , we ae going to discuss about the TDS Setup in Oracle Fusion. We will share the details details steps to configure the TDS process in Oracle Fusion. TDS process is specific to India Location. In Oracle Fusion, We do call TDS as an Withholding Taxes. Both Withholding Tax & TDS tax both is the same thing. Both related to income related taxes. In Oracle Fusion , TDS setups are quite different as compared to TDS setup in the Oracle Apps r12. In Oracle Fusion , There is a sperate tax module to implement the Taxation. In this Taxation module , we do implement both Withholding & Transactional taxes in oracle fusion. In this post , We will share the real time example to configure the TDS in Oracle Fusion. In Oracle Fusion , We first need to create the TDS tax regime under this regime we need to do the TDS setups in oracle fusion. In Oracle Fusion, TDS Setup is quite lengthy and involved too many steps. We have tried our best to put and explain each and every steps sequentially to explain the TDS setup in oracle fusion. Please find below the complete detail about TDS Setup in Oracle Fusion.

|

| TDS Setup in Oracle Fusion |

10 Important Steps to Configure the TDS setup in Oracle Fusion

1. Creation TDS Tax Regime

2.Create TDS taxes under TDS Tax Regime

3. Creating TDS Sections 194C,194H,194I,194J under TDS Taxes

4.Creating Tax Jurisdictions for Withholding Taxes

5.Creating Tax Status for all Withholding Taxes under Tax Regime

6.Creating Tax Rates for Withholding Taxes under Tax Regime

7.Creating Tax Determining Factor Sets for each Withholding Tax Rate

8.Creating Tax Conditions Sets for each Withholding Tax Code

9.Creating Tax Rule for each Withholding Tax Code under each Withholding Taxes

10.Defining Default Taxes Rates for Each Withholding (TDS) Taxes

Detail Steps to Implement the TDS setup in Oracle Fusion

Here below we are sharing the detail steps to Implement the TDS setup in Oracle Fusion.

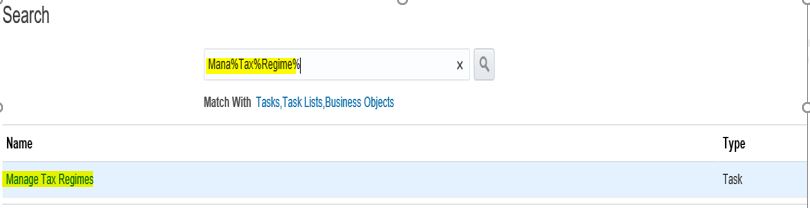

Step 1: Go to ‘Manage Tax Regime’ to create the Tax Regime for TDS Setup.

|

| TDS Setup in Oracle Fusion |

Please ensure, you have selected the Withholding Tax/TDS Option in the radio box.

Click on the ‘+’ icon to create the New Tax regime.

|

| TDS Setup in Oracle Fusion |

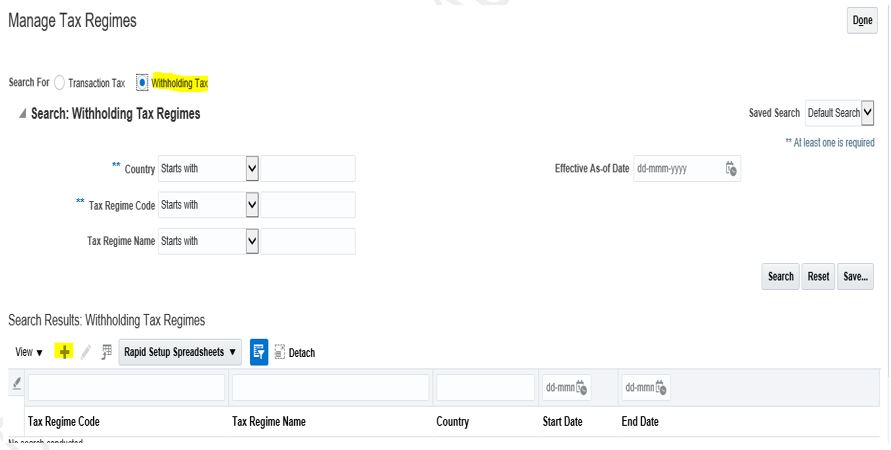

Creating TDS Tax Regime for TDS Setup in Oracle Fusion

Here we are creating the Tax Regime for TDS. We need to enter the Information’s very carefully.

Tax Regime Code: INDIA TDS1

Tax Regime Name; INDIA TDS1

Start Date: - The Date from which you want to start the Taxes. I would recommend using 3 to 4 years back date.

Regime Level: Country (As we have the same Tax Rules across the country so we will select the Country)

Country: India (We are implementing for India).

Tax Currency: INR.

Conversion Rate Type: Corporate (This is very Important, we have to select the right Conversion Rate Type)

Registration Number Controls and Defaults:

Validation Type: ORA_IN_PAN

Validation Level: Warning

|

| TDS Setup in Oracle Fusion |

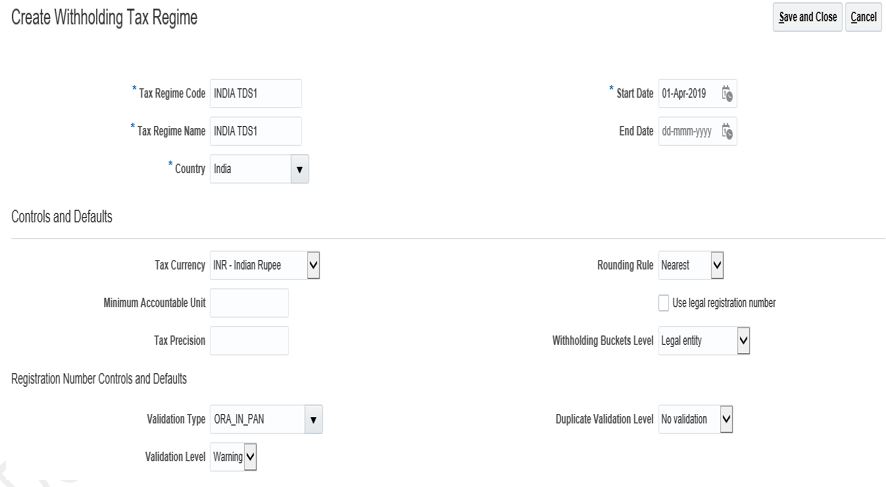

Configuration Options for TDS:

In Configuration options, we need to select the BU’s for which we need to enable this TDS Tax Regime.

Only these BU’s will have the access for this TDS Tax Regime.

Party Name: ABC CORP (We need to select the BU Name which will access these regime tax rates).

Configuration for Taxes and Rules: Common configuration with party overrides.

Configuration for Product Exceptions: Party- specific configurations.

Effective Start Date: Same as the Start Date entered above in the Tax Regime

|

| TDS Setup in Oracle Fusion |

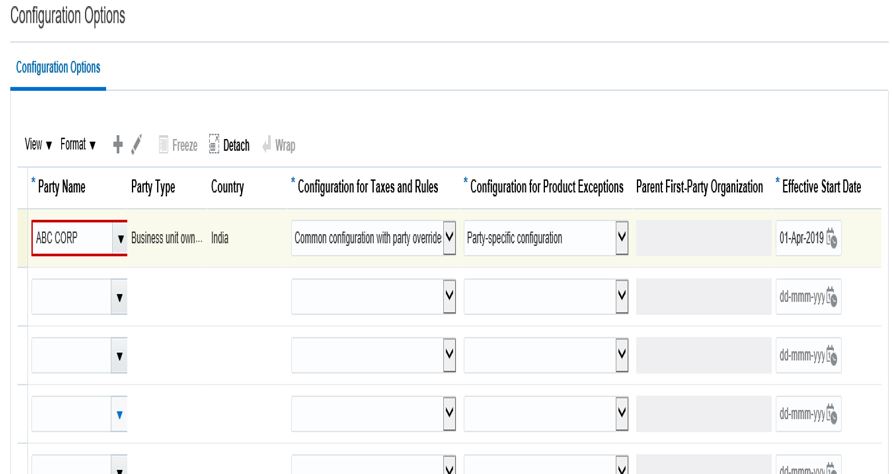

Creating TDS Taxes Under the TDS Tax Regime

Types of Taxes under TDS Tax Regime

1.INDIA_TDS_194C

2.INDIA_TDS_194H

3.INDIA_TDS_194I

4. INDIA_TDS_194J

5. INDIA_TDS_195

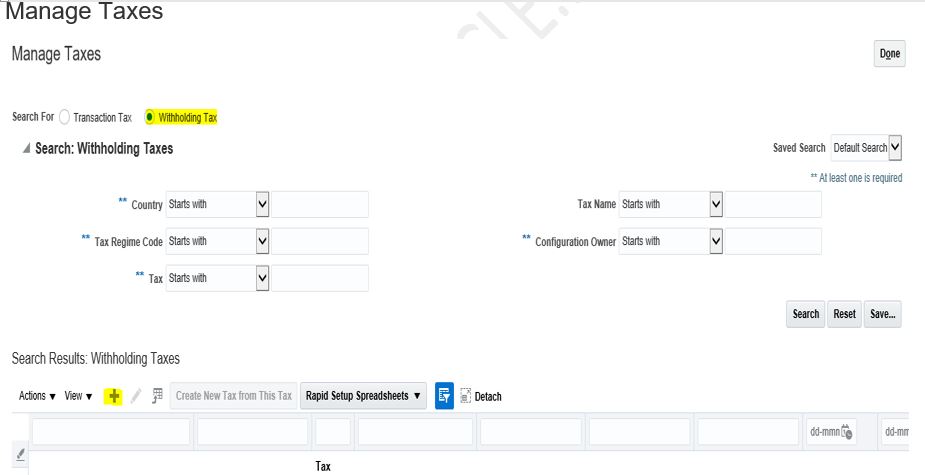

Step1: - Go to Manage Taxes task and will go to this below Page, as below. Click on the ‘+’ icon to create the New Taxes under the Withholding tax regime ‘’India TDS1’.

|

| TDS Setup in Oracle Fusion |

INDIA_TDS_194C

INDIA_TDS_194H

INDIA_TDS_194I

INDIA_TDS_194J

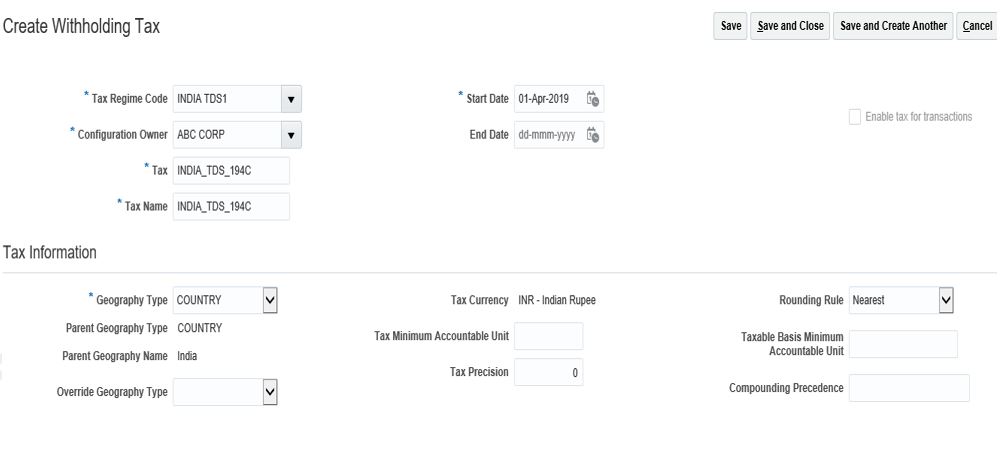

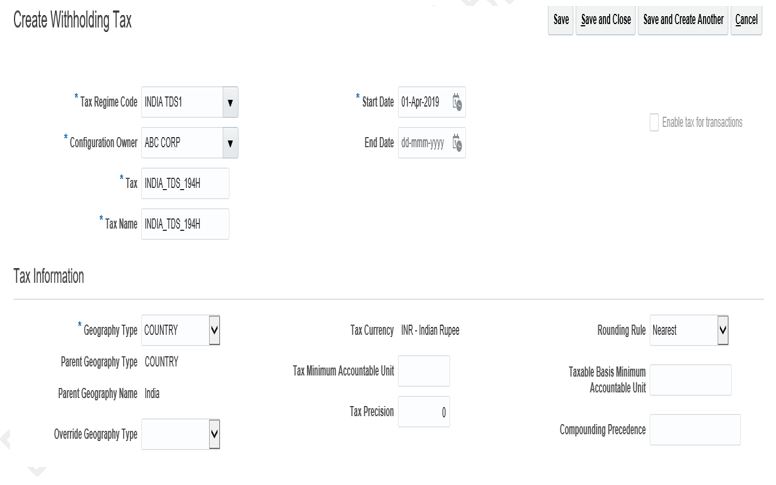

Creating 194C Section TDS Tax in TDS Tax Regime

Tax Regime Code: INDIA TDS1 (Need to select the Right Regime, we created in Last step)

Configuration Owner: ABC CORP (Need to Select the BU Name for which we want to use this Tax).

TAX: INDIA_TDS_194C (TAX Name we need to enter, can enter any name but should be logical).

TAX: INDIA_TDS_194C (TAX Name we need to enter, can enter any name but should be logical).

Start Date: Same Date as we entered in the Tax Regime.

Tax Information:

Geography Type: Country

Tax Currency: INR

Tax Precision: 0 (We don’t want the Tax in Decimal).

|

| TDS Setup in Oracle Fusion |

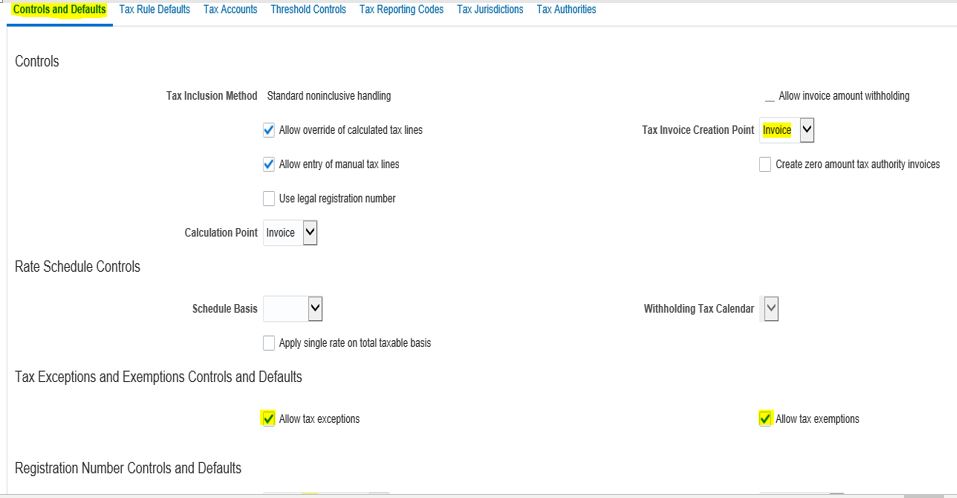

Control and Defaults for TDS Section 194 C:

Tax Point Basis : Invoice

Tax Inclusion Method: Standard non inclusive

Allow override and Entry of inclusive tax lines : Yes

Allow tac rounding overrise: Yes

Allow entry of Manual Tax Lines : Yes

Tax Exceptions and Exemptions for TDS Section 194 C:

Allow Tax Exceptions : Yes

Allow Tax Exemptions : Yes

Validation Type: ORA_IN_PAN

Validation Level: Warning

|

| TDS Setup in Oracle Fusion |

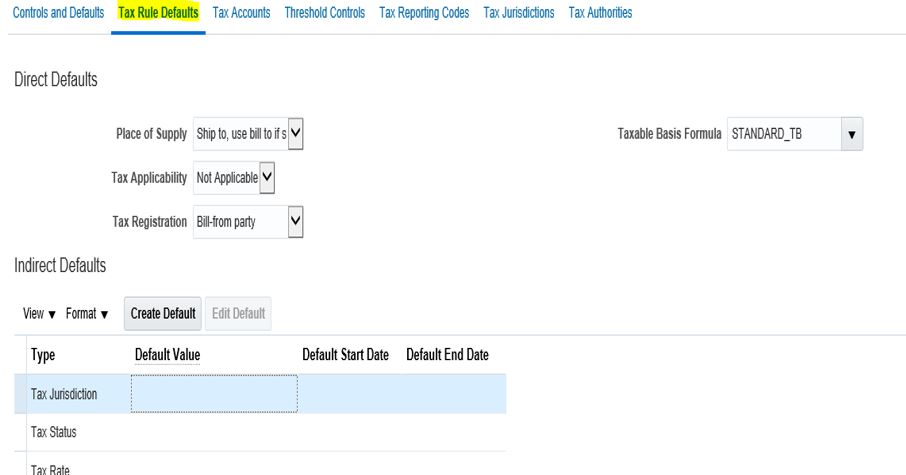

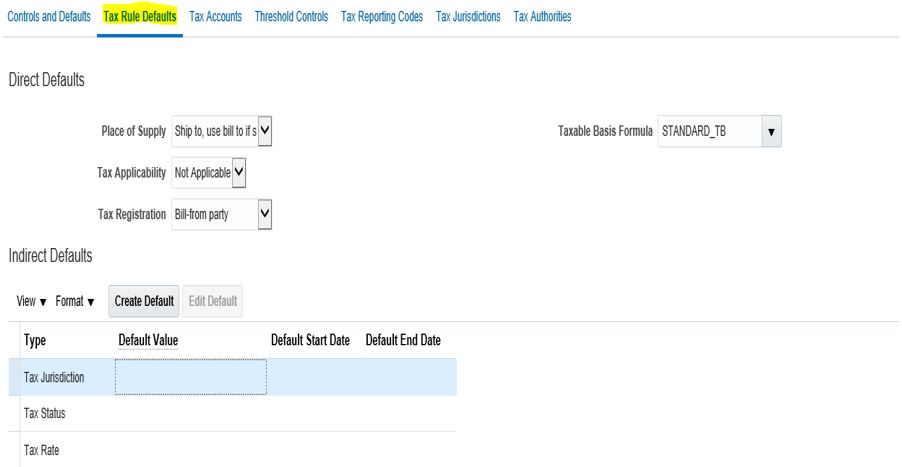

TAX Rule Defaults for TDS Taxes:

Place of Supply : Ship to , use bill to if ship to is null.

Tax Applicability : Not Applicable.

Tax registration : Bill-from party.

|

| TDS Setup in Oracle Fusion |

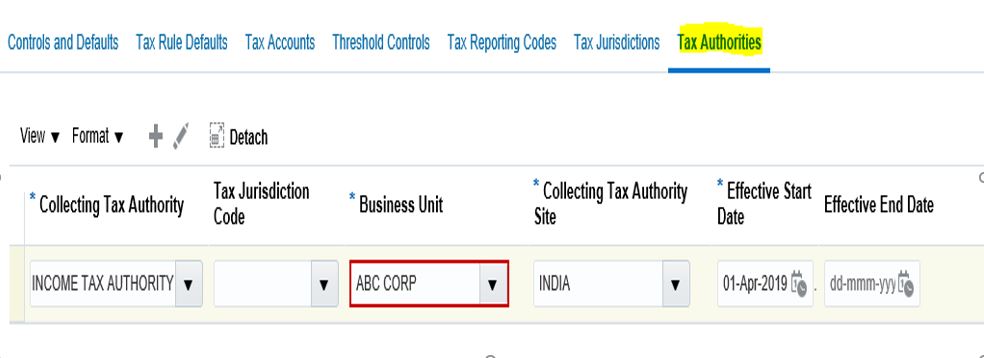

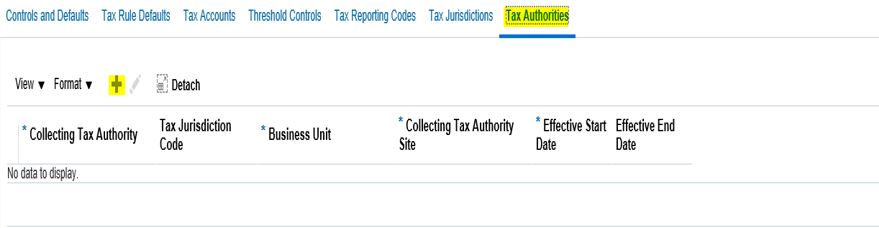

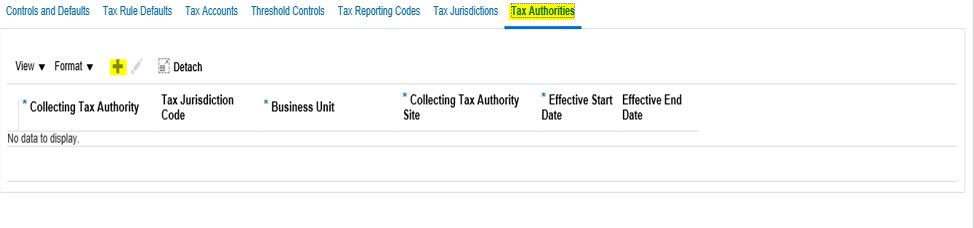

Now We need to create the Tax Authorities as below.

We need to create the 'INCOME TAX AUTHORITY' supplier first and then assign this supplier as below under the Tax Authorities

|

| TDS Setup in Oracle Fusion |

We need to enable this Flag 'Enable for Transaction' for each taxes in tax header as below.

|

| TDS Setup in Oracle Fusion |

|

| TDS Setup in Oracle Fusion |

|

| TDS Setup in Oracle Fusion |

0 comments:

Post a Comment