Part1 GST setup in Oracle Apps : GST configuration in Oracle Apps r12

First create a new supplier

for GST setup in Oracle Application

Create New Supplier ‘GST

Supplier’

Supplier Type should be ‘

India Tax Authority’

Create a New Site Also.

Setup è

Calendar è

Accounting è

Period

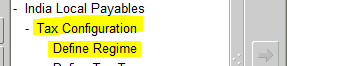

Go to India Local Payables è

Define Regime

After creating supplier , we need to create First GST regime

as below.

Here we will attach the GST supplier created Above and the

GST calendar too.

Now we will define GST Tax Types (CGST, SGST, UGST)

|

| Add caption |

Here we are creating GST tax types(CGST,SGST,UGST) as below.

Select the regime ‘GST’

Tax Type ‘CGST’ . Check the Recoverable Tax check box.

Under accounting Tab , Select the Ledger and Operating Unit

for which you want to configure the GST setup.

Enter the Interim Recovery & Recovery account.

Enter the Interim Liability & Liability account. There

are required for the setup.

Create the Tax types same as above for SGST & UGST.

This topic is quite Large so i will post rest of the steps in the second post. We will create GST Tax Rates , GST Tax category and Party registrations part in the Second Post.

8 comments:

Can somebody help me with GST set up in oracle fusion R12/ R13.I have been waiting for someone who can help me with this. Please.

Hi Sai ,

I will surely help on this but you need to wait for few days. I will try to add the post related to this.

Such a nice blog, I really like what you write in this blog, I also have some relevant Information like this blog.

Oracle Fusion Financials Online Training

Good Blog,thanks for sharing this informative article.

Oracle Fusion SCM Online Training

Can i get the contact number for Online Training (GST Implementation and support skills)

Click here to register Now -->> GST filing online

Hi waqar,

Pls contact at oracleapplicationsblog@gmail.com

Can anybody please say

Where is the second post

Post a Comment