How tax is defaulting from Supplier or from Supplier Address in Oracle Fusion: Tax Default setup for Suppliers In Oracle Fusion

In this post , We will be discuss about How tax is defaulting from Supplier or from Supplier Address in Oracle Fusion. We will share the complete setup steps to Default the tax for Suppliers In Oracle Fusion. We need to perform some setups in supplier master for defaulting the taxes in oracle fusion transactions. This is supplier setup specific to defaulting taxes from Supplier or from Supplier Address in Oracle Fusion.

Implementation step to defaulting tax from Supplier or from Supplier Address in Oracle Fusion

1)Location: Arabia Saudia location

2)Suppliers: Tax Supplier 1, Tax Supplier 2

3)Tax Regime: Tax Regime 1

4)Tax: Tax 1

5)Tax Jurisdiction: Tax Jurisdiction 1

6)Tax Status: Tax Status 1

7)Recovery Rate: Tax Recovery 1

8)Tax Rate: Rate 1 with 5%

9)Tax Rate: Rate 0% with 0%

10) Item: Tax item 1 with category

code: MISC.Misc

11) Item: Tax item 2 with category

code: Computer.Software

12) Item: Tax item 3

with another category code, different than category code for Tax item 1 and Tax

item 2.

13) Item: Tax item 4 with category

code: Computer.Hardware

We need this setup:

1)

Tax

Clasification created as we made in Practice 2

2)

In

Supplier-> insert tax classification create in Practice 2

3)

Setup

from this note:

Tax Classification Is Not

Defaulting Automatically From The Supplier Site (Doc ID 866005.1)

2)In Procurement->Suppliers->

for supplier: Tax Supplier 2-> insert tax classification created in Practice

2

Supplier: Tax Supplier 2

Supplier Site: Riyadh

Tax Classification: RATE 0%

Now tax classification can be

inserted at supplier or supplier address levels.

Please see Tax Classification: RATE

0% inserted at supplier level:

Please see Tax Classification: RATE

0% inserted at address level:

|

| How tax is defaulting from Supplier or from Supplier Address in Oracle Fusion: Tax Default setup for Suppliers In Oracle Fusion |

"Tax classification" and

"Alow tax applicability" are available in Transaction Tax tab from Profile and from Address.

3)Setup from this note:

Tax Classification Is Not

Defaulting Automatically From The Supplier Site (Doc ID 866005.1)

Confirm the Tax Classification is

in fact set properly on the Supplier Address in this case and the defaulting

options are properly having the supplier address to be considered.

1.

Manage

Party Tax Profiles

Search

Third-Party Tax Profile for supplier: Tax Supplier 2

Be

sure that these information are set:

Allow

tax applicability to be checked

Tax

Classification Code: RATE 0%

|

| How tax is defaulting from Supplier or from Supplier Address in Oracle Fusion: Tax Default setup for Suppliers In Oracle Fusion |

2. Manage Party Tax Profiles

- Search for: Third-Party

Site Tax Profiles

- Party name - Enter

the Supplier Name= Tax

Supplier 2

- Party Site Name -

Enter the Supplier Site= Riyadh

- Choose Search

-Edit

Be sure that these information are

set:

-

Allow

tax applicability to be checked

-

Tax

Classification Code: RATE 0%

3. Go in Manage Application Tax

Options task:

- Enter the Business Unit: DOO Fusion CSPS Business Unit 1

- Select Application Name: Purchasing

- Choose search

- Choose Edit

- In this screen ensure that you

have the defaulting logic if you want that tax classification to default from

supplier site level:

Default Order 1: Supplier Site

Default Order 2: Supplier

|

| How tax is defaulting from Supplier or from Supplier Address in Oracle Fusion: Tax Default setup for Suppliers In Oracle Fusion |

- Choose Save and Close

If you want that tax classification

to default from supplier level is necessary this order:

Default Order 1: Supplier

Default Order 2: Supplier Site

4. Retest and confirm that now the

tax classification is in fact being pulled in from the supplier site for the

purchase order shipment.

|

| How tax is defaulting from Supplier or from Supplier Address in Oracle Fusion: Tax Default setup for Suppliers In Oracle Fusion |

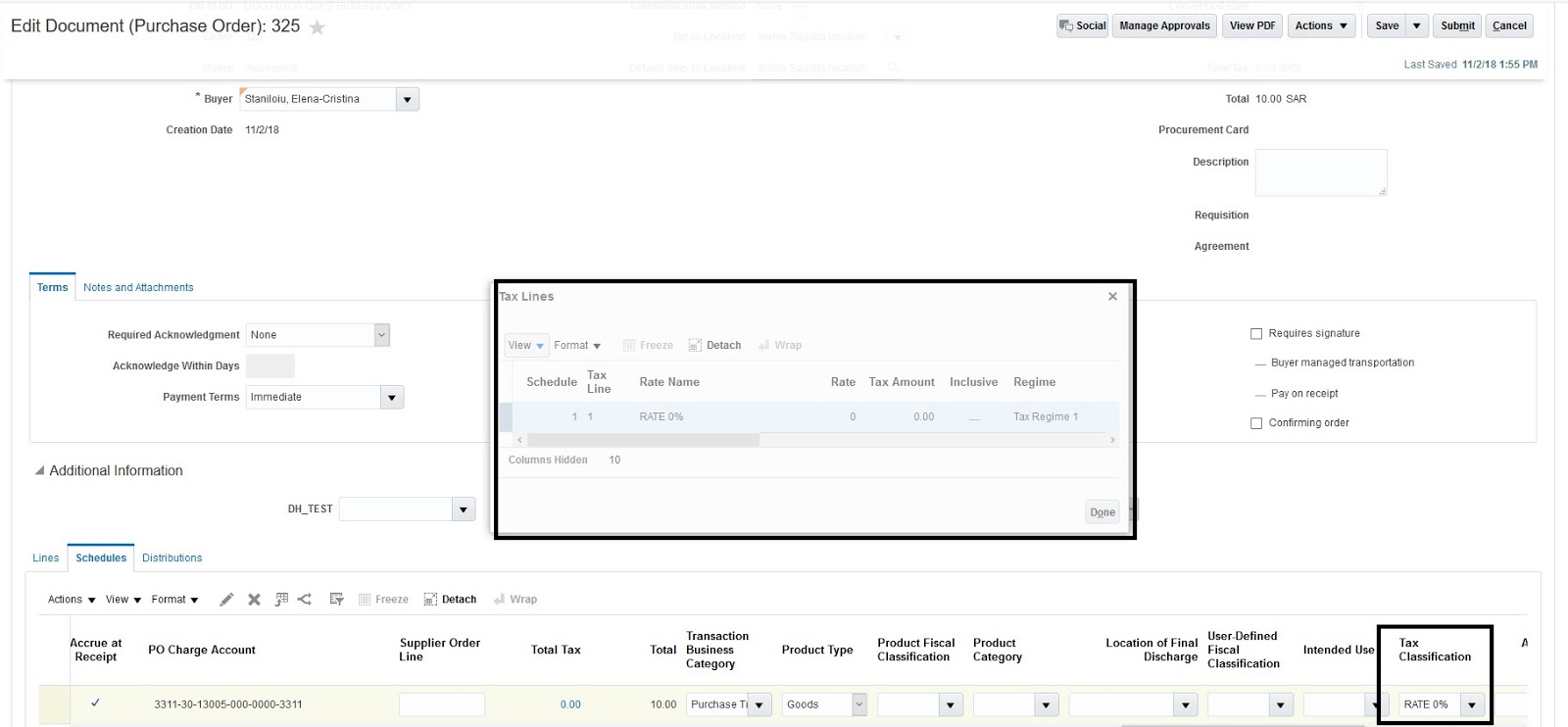

Create a new PO: 325 with supplier:

Tax Supplier 2 and supplier site: Riyadh

PO: #325 is created and tax with 0%

is calculating from supplier site level (in Manage Application Tax Options Default

Order 1: Supplier Site

Default Order 2: Supplier)

Tax is 0% and it is calculated

based on supplier site level and also the field: Tax Classification from

Schedules is populated automatically with RATE 0%.

|

| How tax is defaulting from Supplier or from Supplier Address in Oracle Fusion: Tax Default setup for Suppliers In Oracle Fusion |

0 comments:

Post a Comment