Withholding Tax Implementation in Oracle Fusion

Creating Tax Regime for Withholding Tax

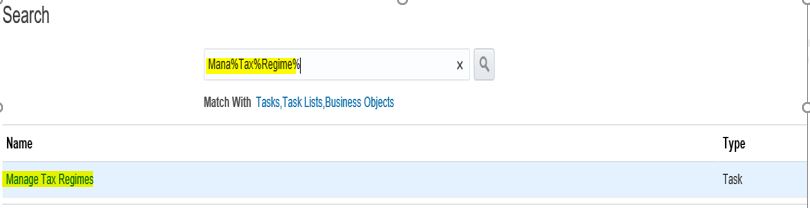

Step 1: Go to ‘Manage Tax Regime’ to create the Tax Regime for Withholding Tax.

|

| Withholding Tax Implementation in Oracle Fusion |

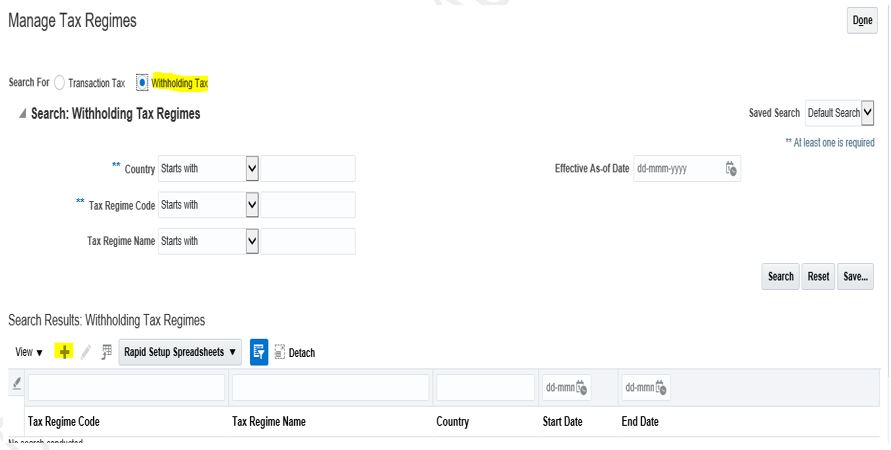

Here below is the Tax Regime, where we need to create the Transaction Tax Regime for GST.

Please ensure, you have selected the Transaction Tax Option in the radio box.

Click on the ‘+’ icon to create the New Tax regime.

|

| Withholding Tax Implementation in Oracle Fusion |

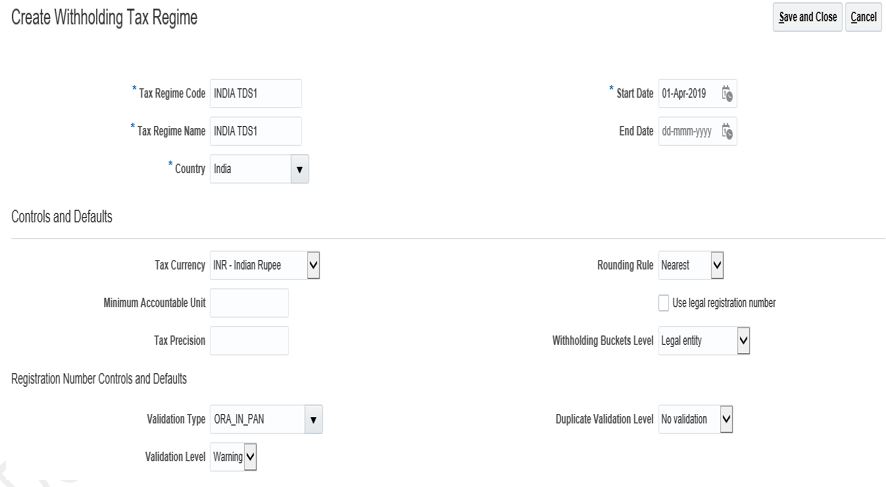

Creating Tax Regime for Withholding Tax

Here we are creating the Tax Regime for GST. We need to enter the Information’s very carefully.

Tax Regime Code: INDIA TDS1

Tax Regime Name; INDIA TDS1

Start Date: - The Date from which you want to start the Taxes. I would recommend using 3 to 4 years back date.

Regime Level: Country (As we have the same Tax Rules across the country so we will select the Country)

Country: India (We are implementing for India).

Tax Currency: INR.

Conversion Rate Type: Corporate (This is very Important, we have to select the right Conversion Rate Type).

Registration Number Controls and Defaults:

Validation Type: ORA_IN_PAN

Validation Level: Warning

|

| Withholding Tax Implementation in Oracle Fusion |

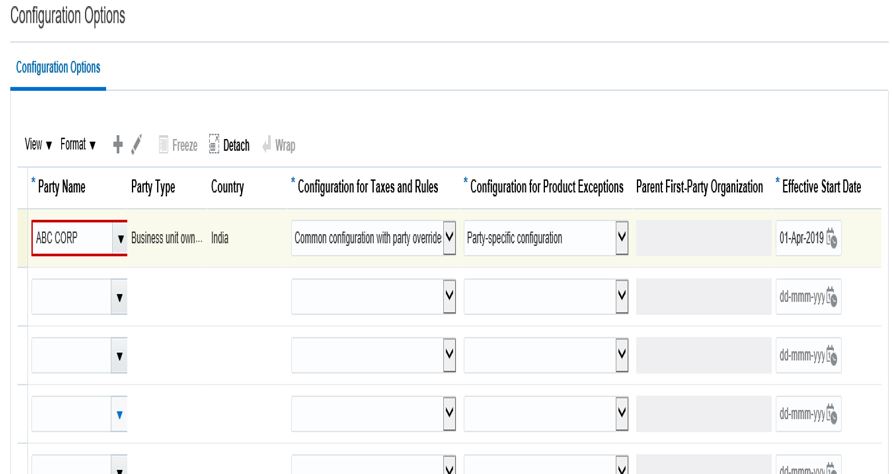

Configuration Options:

In Configuration options, we need to select the BU’s for which we need to enable this Tax Regime.

Only these BU’s will have the access for this Tax Regime.

Party Name: ABC CORP (We need to select the BU Name which will access these regime tax rates).

Configuration for Taxes and Rules: Common configuration with party overrides.

Configuration for Product Exceptions: Party- specific configurations.

Effective Start Date: Same as the Start Date entered above in the Tax Regime

|

| Withholding Tax Implementation in Oracle Fusion |

In the next Post , We will create the withholding taxes Under Withholding Tax Regime.

0 comments:

Post a Comment